rostov-na-donu-vashinvestor.ru Tools

Tools

How Do I Learn About Trading Stocks

In this course, we will lead you through the fundamentals to help you learn how to trade stocks and get started on this financial journey. Stock trading for beginners involves considering your overall investment aims and your reasons for investing. Your risk-profile will dictate which types of. 1. Educate yourself: Start by reading books, articles, and online resources about stock trading. · 2. Take a course: Consider enrolling in a. A stock trader or equity trader or share trader, also called a stock investor, is a person or company involved in trading equity securities and attempting. To trade stocks, you need to set clear investment goals, determine how much you can invest, decide how much risk you can tolerate, pick an account at a broker. We can help you understand what a stock market is, and how it works so the thought of investing seems less overwhelming. Take the mystery out of the stock market with a stock trading course from Udemy. Learn from real-world experts with easy-to-understand videos and exercises. In summary, here are 10 of our most popular stock market courses · Financial Markets: Yale University · Practical Guide to Trading: Interactive Brokers. Looking to trade stocks online? Fidelity offers unlimited trades and low commissions with its stock trading account. Learn more here. In this course, we will lead you through the fundamentals to help you learn how to trade stocks and get started on this financial journey. Stock trading for beginners involves considering your overall investment aims and your reasons for investing. Your risk-profile will dictate which types of. 1. Educate yourself: Start by reading books, articles, and online resources about stock trading. · 2. Take a course: Consider enrolling in a. A stock trader or equity trader or share trader, also called a stock investor, is a person or company involved in trading equity securities and attempting. To trade stocks, you need to set clear investment goals, determine how much you can invest, decide how much risk you can tolerate, pick an account at a broker. We can help you understand what a stock market is, and how it works so the thought of investing seems less overwhelming. Take the mystery out of the stock market with a stock trading course from Udemy. Learn from real-world experts with easy-to-understand videos and exercises. In summary, here are 10 of our most popular stock market courses · Financial Markets: Yale University · Practical Guide to Trading: Interactive Brokers. Looking to trade stocks online? Fidelity offers unlimited trades and low commissions with its stock trading account. Learn more here.

1. Consider getting a broker. The easiest way to trade stocks will be to pay someone else to trade stocks. There are a number of well known stock brokers. 2. Master one area. Don't try to trade every stock in every sector as it can get confusing. Instead, become as knowledgeable as you can in one sector or. This article will cover stock trading methods, a step-by-step how-to guide on share trading and an overview of where to trade stocks. Looking to trade stocks online? Fidelity offers unlimited trades and low commissions with its stock trading account. Learn more here. In this article, we will cover all you need to know about stock trading by highlighting key practices you must embrace to improve your chances of success. Educate Yourself: Start by gaining a solid understanding of the fundamentals of the stock market. · Set Clear Goals: Determine your investment. Stock selection using technical analysis generally involves three steps: stock screening, chart scanning, and setting up the trade. With stock screening, your. Stock trading is the process of buying and selling company shares listed on a stock exchange. The aim is to potentially benefit from price fluctuations. We've outlined everything you need to know for your trading journey, including how to trade stocks and forex trading for beginners. Trading Academy is a leader in investing and stock trading education. Sign up for a class today to learn step-by-step strategies on how to trade smarter. This guide is designed to simplify the complexities of stock trading, providing you with a clear pathway to confidently take your first steps into the world of. Popular in trading · What to Watch as You Trade · Swing Trading Stock Strategies · Ins and Outs of Short Selling · Futures Trader on thinkorswim® · Understanding. Learn How to Trade On Stock Markets With LAT. LAT is a dual-accredited institution and provides training and education for those wishing to learn about trading. 5. BUYING OR SELLING YOUR FIRST STOCK · Log in to the platform · Enter the symbol of the stock, then press enter · Click on the ASK price if you want to buy. 1. Consider getting a broker. The easiest way to trade stocks will be to pay someone else to trade stocks. There are a number of well known stock brokers. Research the available markets you can start trading · Shares: go long ('buy') or short ('sell') on over12, shares, like Apple, Tencent and Lloyds · Indices. Trading stocks is all tied in with a company or asset's share price. You're probably familiar with the old investor mantra: buy low and sell high. While it. Day trading simply means buying and selling stocks within the same trading day while holding no positions overnight. Stocks are bought and sold on a stock exchange such as the New York Stock Exchange (NYSE) and in the private market, where individual and institutional. Popular in trading · What to Watch as You Trade · Swing Trading Stock Strategies · Ins and Outs of Short Selling · Futures Trader on thinkorswim® · Understanding.

How Much Can I Sell My Plasma For

Make your blood donation go further by donating blood plasma. A single AB Elite donation can provide up to three units of plasma to patients in need. How often can I donate plasma? You can donate plasma every 28 days. Please consider donating plasma as part of your regular routine. Are there special. Why donate blood plasma? Plasma increases blood volume in emergencies and can be used to make products that fight disease and infection. Learn more. Your first donation will take approximately two hours. Return visits take much less time. You will be compensated for donating plasma in the U.S.,typically. plasma donation, depending on how much you can donate. Can you work out after donating plasma? PlasmaSource recommends avoiding vigorous exercise for Plasma donors should be at least 18 years old · Plasma donors should weigh at least pounds or 50 kilograms · Must pass a medical examination · Complete an. Join the thousands of people who safely donate plasma each week at CSL Plasma and get rewarded for your time. F A. Q s. f. r. o. m. y. o. u · Who can donate? · What type of medical screening is required? · Is donating plasma safe? · Does it hurt? · How long does it take? Your donated plasma will be turned into live-saving therapies. Help make others healthy and happy! Earn Money. Donating. Make your blood donation go further by donating blood plasma. A single AB Elite donation can provide up to three units of plasma to patients in need. How often can I donate plasma? You can donate plasma every 28 days. Please consider donating plasma as part of your regular routine. Are there special. Why donate blood plasma? Plasma increases blood volume in emergencies and can be used to make products that fight disease and infection. Learn more. Your first donation will take approximately two hours. Return visits take much less time. You will be compensated for donating plasma in the U.S.,typically. plasma donation, depending on how much you can donate. Can you work out after donating plasma? PlasmaSource recommends avoiding vigorous exercise for Plasma donors should be at least 18 years old · Plasma donors should weigh at least pounds or 50 kilograms · Must pass a medical examination · Complete an. Join the thousands of people who safely donate plasma each week at CSL Plasma and get rewarded for your time. F A. Q s. f. r. o. m. y. o. u · Who can donate? · What type of medical screening is required? · Is donating plasma safe? · Does it hurt? · How long does it take? Your donated plasma will be turned into live-saving therapies. Help make others healthy and happy! Earn Money. Donating.

How much can I make each month? B Positive donors are financially compensated for the time they spend donating blood plasma. New (first-time) donors can. How Should I Prepare for My Plasma Donation? It's important to be in good physical condition before donating blood or plasma. Here's a checklist of what you. What should I bring on my first visit? When you come for your first donation I'M INTERESTED IN DONATING. New donors · Donor eligibility · My first. Your CCP donation can help as many as people fight this virus! What is the donation process for donating convalescent plasma? Plasma is donated through a. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. How do I donate plasma? Donating plasma is similar to giving blood and plasma donors can receive compensation for their time. Our donation experience begins. Allergy and immune disorder patients: Your antibody-rich plasma can help change the lives of people around the world. blood sample to determine antibody. Donating plasma takes time and commitment. To help ensure a safe and adequate supply of plasma, donors are provided with a modest stipend to recognize the. How long does it take to donate plasma? Donating plasma takes longer than donating blood due to thorough health screening requirements and the process of. If you are over 65 you can start donating plasma if you have donated blood blood you have and work out how much plasma you can safely donate. Use this. Donating frequently throughout the year ensures that we always have an ample blood supply for patients in need. How It Works. Each time you make a blood. The rumors are true: you CAN make money donating plasma. But it's a time-consuming (and potentially painful) process. Here's how it works. How Can You Help? Become a plasma donor it's your turn! Donating plasma is important for our entire healthcare system. We encourage anyone who can donate to. What is plasma and why is it important? Plasma serves many important functions in our body. Learn more about plasma and its importance AB plasma can be given. We are here to help you donate plasma! We know that there are many questions that may be coming to mind while you are considering donating plasma for the. Learn how to donate plasma for the first time. Find more about CSL's donor-focused plasma donation process, qualifications, and how to get compensated. Plasma donation centers in the U.S. compensate donors, and many allow frequent donations. How often can you donate plasma and is it healthy? What should I bring on my first visit? When you come for your first donation I'M INTERESTED IN DONATING. New donors · Donor eligibility · My first. Plasma Donations Thank you for your interest in donating plasma. The Central California Blood Center services 5 counties, over 20 hospitals. Does Bloodworks pay donors for plasma donations? · How do I become a plasma donor? · How can I make my donation successful? · What does plasma donation feel like?

Closing Costs On 190 000 House

I would estimate between $k cash at closing from the buyer. You will probably need: Home Insurance premium - about $ On average, you can expect to pay between 2% to as much as 5% of the home's purchase price in closing costs. These costs typically include fees for items like. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. Approx Costs: % of the home value. Homeowners Association Fees: The seller pays this fee to manage and maintain their property if it comes under the. Cost Comparison Over Time ; Mortgage Fees, $ ; Other Closing Costs, -$18, ; Ongoing Expenses, -$, ; Mortgage Payment, -$, Closing Costs: Closing costs can be negotiated between the buyer and seller. The average cost of closing fees for homebuyers is $6, The higher the purchase price of your home, the higher your closing costs will be. While the average. The buyer and seller usually split the costs 50/ Closing costs may include: Home appraisal fees; Title insurance; Home inspection; Loan. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges. I would estimate between $k cash at closing from the buyer. You will probably need: Home Insurance premium - about $ On average, you can expect to pay between 2% to as much as 5% of the home's purchase price in closing costs. These costs typically include fees for items like. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. Approx Costs: % of the home value. Homeowners Association Fees: The seller pays this fee to manage and maintain their property if it comes under the. Cost Comparison Over Time ; Mortgage Fees, $ ; Other Closing Costs, -$18, ; Ongoing Expenses, -$, ; Mortgage Payment, -$, Closing Costs: Closing costs can be negotiated between the buyer and seller. The average cost of closing fees for homebuyers is $6, The higher the purchase price of your home, the higher your closing costs will be. While the average. The buyer and seller usually split the costs 50/ Closing costs may include: Home appraisal fees; Title insurance; Home inspection; Loan. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges.

Another factor that determines how much house you can afford is the amount of money you have available to make a down payment and cover closing costs. A closing costs calculator for buyers gives you an estimate of your closing costs while buying a house after deducting local closing costs. Buyer closing. down payment and cover closing costs. They help you estimate the house price you can afford and the mortgage rates best for your financial situation. Use the calculator to determine the down payment and monthly payment of a k house. Purchase Price. $. Down Payment. $. Percent Down. %. APR - View Rates. %. Use this closing costs calculator to estimate your total closing expenses on your home mortgage, including prepaid items, third-party fees and escrow. Interest rates are expressed as an annual percentage. A lower interest rate gives you a smaller monthly payment. Loan term (years): The term is the. What You Should Know · Closing costs are the fees that are paid by both the seller and buyer of a home for various services that are required before closing on. New Yorkers buying a home in Florida will be pleasantly surprised to find that closing costs down here are substantially lower than the closing costs. Buyers often ask sellers to pay some of their closing and mortgage costs. This typically ranges between 1% and 2% of the sales price. Home Ownership and. A closing cost calculator can estimate the amount of your closing costs, which can be helpful from a budgeting and preparation perspective. Use our closing cost estimator to calculate the closing costs on your mortgage. Get the estimates & info you need with our closing cost calculator. Monthly Pay: $1, ; Total Out-of-Pocket, $2,, $1,, ; 70% 14% 4% 12% Principal & Interest Property Taxes Home Insurance Other Cost ; House Price. Closing Costs: $4, Press spacebar to show inputs. Loan APR %. [+] Any interest paid on first or second mortgages over this amount is not tax. Your closing costs will vary depending on the new loan amount and your credit score, debt-to-income ratio, loan program and interest rate. The national average. FHA Closing Cost Calculator. Use this calculator to quickly estimate the closing costs on your FHA home loan. Get Current FHA Loan Rates. New Yorkers buying a home in Florida will be pleasantly surprised to find that closing costs down here are substantially lower than the closing costs. Closing Costs. -. Year, Beginning Balance, Total Payment, Principal, Interest, Ending The total cost of home ownership is more than just mortgage payments. Closing costs are typically around % of the loan amount. If you're making a small down payment, this could nearly double your out-of-pocket costs — so make. Monthly, Total ; Mortgage Payment, $1,, $, ; Property Tax, $, $, ; Home Insurance, $, $45, ; Other Costs, $

Yinn Ticker

Direxion Daily FTSE China Bull 3X Shares (YINN). 1D. 5D. 1M. 6M. YTD The bid & ask refers to the price that an investor is willing to buy or sell a stock. (YINN) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the Moomoo stock trading app. YINN | A complete Direxion Daily FTSE China Bull 3X Shares exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. Direxion YINN ETF (Direxion Daily China Bull 3x Shares ETF - USD): stock price, performance, provider, sustainability, sectors, trading info. YINN has a Non-Diversified Portfolio. Holdings Details. •: % Category Foreign Stock. , , •: Cash. , , Non-U.S. assets may. · Partner Content · Your Watchlists · Recently Viewed Tickers · YINN Options · August · September · October YINN provides daily 3x leveraged exposure to a market-cap-weighted index of the 50 largest Chinese stocks traded in Hong Kong. The FTSE China 50 Index consists of the 50 largest and most liquid public Chinese companies currently trading on the Hong Kong Stock Exchange. Fund Summary for. YINN is an aggressive daily bet on Chinese large-cap equities, delivering 3x leveraged exposure to about 50 large and liquid names traded in Hong Kong. Direxion Daily FTSE China Bull 3X Shares (YINN). 1D. 5D. 1M. 6M. YTD The bid & ask refers to the price that an investor is willing to buy or sell a stock. (YINN) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the Moomoo stock trading app. YINN | A complete Direxion Daily FTSE China Bull 3X Shares exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. Direxion YINN ETF (Direxion Daily China Bull 3x Shares ETF - USD): stock price, performance, provider, sustainability, sectors, trading info. YINN has a Non-Diversified Portfolio. Holdings Details. •: % Category Foreign Stock. , , •: Cash. , , Non-U.S. assets may. · Partner Content · Your Watchlists · Recently Viewed Tickers · YINN Options · August · September · October YINN provides daily 3x leveraged exposure to a market-cap-weighted index of the 50 largest Chinese stocks traded in Hong Kong. The FTSE China 50 Index consists of the 50 largest and most liquid public Chinese companies currently trading on the Hong Kong Stock Exchange. Fund Summary for. YINN is an aggressive daily bet on Chinese large-cap equities, delivering 3x leveraged exposure to about 50 large and liquid names traded in Hong Kong.

Complete Direxion Daily FTSE China Bull 3X Shares funds overview by Barron's. View the YINN funds market news. International stock quotes are delayed as per. Is Direxion Daily FTSE China Bull 3X (YINN) a good investment? YINN has underperformed the market in the last year with a price return of % while the SPY. (YINN) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the Moomoo stock trading app. with unique ISIN - USG Main exchange is NYSE Arca and ticker symbol is YINN. The total expense ratio is %. The Direxion Daily FTSE China Bull. Direxion Daily FTSE China Bull 3X Shares YINN:NYSE Arca ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High The current share price for Direxion Daily FTSE China Bull 3X Shares (YINN) stock is $ for Friday, June 21 , down % from the previous day. Direxion Daily FTSE China Bull 3X Shares (YINN) · Invest in YINN · About Direxion Daily FTSE China Bull 3X Shares (YINN) · YINN Stock News · Frequently Asked. About YINN The Direxion Daily FTSE China Bull 3X Shares (YINN) is an exchange-traded fund that is based on the FTSE China 50 Net Tax USD index. The fund. YINN Stock Profile & Price. YINN Stock Profile & Price; Dividend & Valuation; Expenses Ratio & Fees; Holdings; Holdings Analysis Charts; Price and Volume Charts. YINN, $YINN, Direxion Daily FTSE China Bull 3X Shares stock technical analysis with charts, breakout and price targets, support and resistance levels. YINN is an aggressive daily bet on Chinese large-cap equities, delivering 3x leveraged exposure to about 50 large and liquid names traded in Hong Kong. The. View the latest Direxion Daily FTSE China Bull 3X Shares (YINN) stock price and news, and other vital information for better exchange traded fund investing. Get detailed information about the Direxion Daily FTSE China Bull 3x Shares ETF. View the current YINN stock price chart, historical data, premarket price. Find the latest news headlines about Direxion Daily FTSE China Bull 3X Shares (YINN) at rostov-na-donu-vashinvestor.ru The FTSE China 50 Index (TXIN0UNU) consists of the 50 largest and most liquid public Chinese companies currently trading on the Hong Kong Stock Exchange as. YINN - Direxion Daily FTSE China Bull 3X Shares - Stock screener for investors and traders, financial visualizations. Check out our YINN stock analysis, current YINN quote, charts, and historical prices for FTSE China Bull 3X Direxion stock. Latest Direxion Daily FTSE China Bull 3X Shares (YINN) stock price, holdings, dividend yield, charts and performance. Get the latest Direxion Daily FTSE China Bull 3x Shares (YINN) real Stock market today: Nasdaq leads stock climb as Powell says 'time has come. YINN Key Statistics Sign up for a Robinhood brokerage account to buy or sell YINN stock and options commission-free. Other fees may apply. See Robinhood.

What Is The Best Purpose For A Loan

1. Paying off debt Debt consolidation is the most common reason that people take out personal loans. The average American has about four credit cards in their. 1. Get Eligibility 2. Loan Offer 3. Complete Application LOAN PURPOSE Purpose of loan* Personal Loan SBI LAP (Loan Against Property) Click to read the scheme. Debt is one of the most common reasons people take out business loans. There are a few different ways to use a loan to pay off debt. The first is to consolidate. When life's surprises are more than you budgeted for, a personal loan can help you manage a larger expense. Share Secured. Share Secured · All Purpose Loan. When seeking a loan, the goal is to present the best possible business case in the form of a loan proposal. A well-developed loan proposal helps lenders. Use your Personal Loan to improve your home, whether it's upgrading your kitchen or building a home office. With fixed monthly payments and repayment options. "I want to buy a camper". That's the reason you give for the loan because that's what you plan on doing. The lender doesn't need to know that. Personal loans for kicking goals. Low rates starting from % pa (comparison rate from % pa*) with money in your bank account in as little as 60 minutes. Just to add on, it's also about security on the loans. A car or home loan will usually offer some security to the lender as they can claim. 1. Paying off debt Debt consolidation is the most common reason that people take out personal loans. The average American has about four credit cards in their. 1. Get Eligibility 2. Loan Offer 3. Complete Application LOAN PURPOSE Purpose of loan* Personal Loan SBI LAP (Loan Against Property) Click to read the scheme. Debt is one of the most common reasons people take out business loans. There are a few different ways to use a loan to pay off debt. The first is to consolidate. When life's surprises are more than you budgeted for, a personal loan can help you manage a larger expense. Share Secured. Share Secured · All Purpose Loan. When seeking a loan, the goal is to present the best possible business case in the form of a loan proposal. A well-developed loan proposal helps lenders. Use your Personal Loan to improve your home, whether it's upgrading your kitchen or building a home office. With fixed monthly payments and repayment options. "I want to buy a camper". That's the reason you give for the loan because that's what you plan on doing. The lender doesn't need to know that. Personal loans for kicking goals. Low rates starting from % pa (comparison rate from % pa*) with money in your bank account in as little as 60 minutes. Just to add on, it's also about security on the loans. A car or home loan will usually offer some security to the lender as they can claim.

Top reasons to consider a personal loan include debt consolidation, emergencies, etc. Learn what personal loans are used for to help achieve your goals. 7(a) loans. Woman working on a lap top. SBA's primary program for providing long-term financing for a variety of purposes. Same-day business loans are streamlined to deliver funding within 24 hours of loan approval. Get the cash you need quickly with the minimum of fuss. Top 7 Reasons to Get a Personal Loan · Reason #1 - Consolidate Your Debt · Reason #2 - Make A Large Purchase · Reason #3 - Fund An Upcoming Expense · Reason #4. A common use for personal loans is to consolidate high-interest debt. By taking out a personal loan to pay off other loans or credit card debt, you can. Generally, the only time you'll need to specify a purpose for your personal loan is if you're planning debt consolidation. Also, it's best to keep business. The most frequently approved reason for obtaining a personal loan is debt consolidation. Many people use personal loans to consolidate high-. Personal Loans · Auto Loan. Get a great ride with a fixed rate. We offer a variety of terms to fit your budget. · General Purpose Loan. Consolidate debt, take a. Fast approvals. Same-day access to cash. No collateral needed. An unsecured personal loan is a great choice to consolidate debt, or to pay for home improvements. A debt consolidation loan may not be best for those with bad credit, as Loan purpose: If you choose to take out a loan that offers a flexible loan. goal – such as buying a car, consolidating debt or another major expense? Then a loan might be a better option. It provides a lump sum of money up front. A debt consolidation loan may not be best for those with bad credit, as Loan purpose: If you choose to take out a loan that offers a flexible loan. Shorter loan terms generally save you money overall, but have higher monthly payments. There are two reasons shorter terms can save you money: You are borrowing. A loan may be withdrawn due to dissatisfaction with the property or desire to use another lender, among other reasons. Back to top. MOP-Calculator: A web. A loan lets you borrow a specific amount of money in one lump sum. It's ideal for single transactions, such as major purchases, home renovations or paying. Best Credit Unions for Personal Loans. GoBankingRates.. Best Credit Calculated results are estimates for illustrative purposes only and may not apply to. If you need all the funds simultaneously, then a loan is a better option due to the lower interest rates. Line of credit vs. loan – Which one is best? Choosing. Personal loans can be used for a wide variety of purposes, from consolidating debt to financing a large purchase. Before taking out a personal loan, it's. Two other options—payday loans and title loans—are last resorts that you should aim to avoid due to high fees and the risk of falling into a cycle of debt.

Mortgage Rate Fluctuation

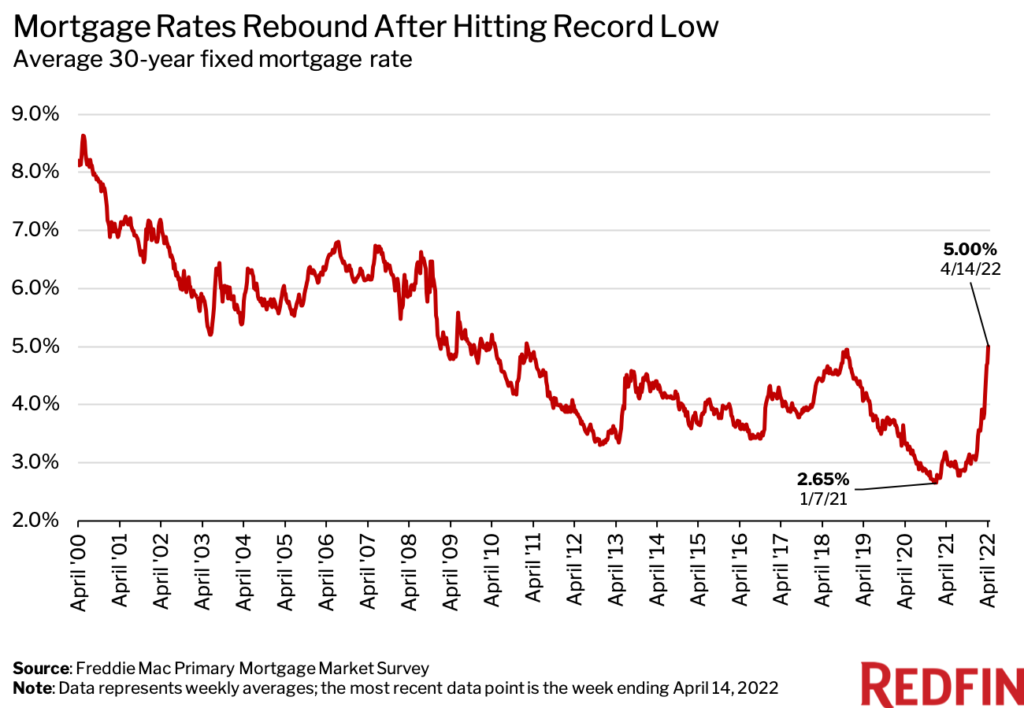

Follow day-to-day movement in mortgage rates our daily index, driven by real-time changes in actual lender rate sheets. Fluctuation Of Mortgage Interest Rates Can Happen For Many Reasons · Your Risk Factor · Economic Stability · Supply and Demand · Global Events. According to Freddie Mac's records, the average year rate jumped from % in January to a high of % at the end of October. Find your lowest mortgage. Interest rates can change at any time, sometimes the even fluctuate more than once a day. Variable rates fluctuate even more frequently and can often change. Mortgage rate volatility refers to the fluctuation in interest rates for mortgage loans over time. These fluctuations can be influenced by various economic. Average Mortgage Rates Between and ; Oct. 6, , $1,, , , View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. Follow day-to-day movement in mortgage rates our daily index, driven by real-time changes in actual lender rate sheets. Fluctuation Of Mortgage Interest Rates Can Happen For Many Reasons · Your Risk Factor · Economic Stability · Supply and Demand · Global Events. According to Freddie Mac's records, the average year rate jumped from % in January to a high of % at the end of October. Find your lowest mortgage. Interest rates can change at any time, sometimes the even fluctuate more than once a day. Variable rates fluctuate even more frequently and can often change. Mortgage rate volatility refers to the fluctuation in interest rates for mortgage loans over time. These fluctuations can be influenced by various economic. Average Mortgage Rates Between and ; Oct. 6, , $1,, , , View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing.

The average rate on a year fixed mortgage remained relatively stable at % as of August 22, marking its lowest level since mid-May , according to. Even if you have a fixed-rate mortgage the monthly payment amount may fluctuate during the life of the loan. Five main things that cause mortgage rates to deviate. · 1. The Federal Reserve. The Fed sets the federal funds rate, which affects the cost of. These changes also affect how the mortgage rates are set. If the majority of people are struggling to secure a mortgage loan, even with lower interest rates. Mortgage rates dipped again this week, with the year fixed rate inching down to percent, according to Bankrate's latest lender survey. Fixed rates stay the same until the end of the term and protect you from fluctuations in our prime rate. This option might work for you if you have a low. Lenders will usually offer a low rate that is fixed for a few years. Once that time limit is up, the rate will fluctuate at least once a year. These types of. Expert poll: Mortgage rate trend predictions for Sept. 5 - 11, · 0% say rates will go up · 60% say rates will go down · 40% say unchanged– · More information. The U.S. housing market is recovering following Federal Reserve interest rate hikes that increased the cost of mortgages. Learn more about how market. As a result, if you're in the market for a new home, rising inflation could make your monthly mortgage payments more expensive, depending on the terms and type. Expert poll: Mortgage rate trend predictions for Sept. 5 - 11, · 0% say rates will go up · 60% say rates will go down · 40% say unchanged– · More information. A mortgage rate is the interest rate you pay on your mortgage loan. Mortgage rates change daily and are based on fluctuations in the market. Depending on. Interest rates change due to fluctuations in the supply and demand of credit. When demand for credit is high or when supply of credit is low, interest rates. As we can see from looking at interest rate fluctuations, major economic events can significantly impact mortgage rates both in the short and long term. As. Mortgage rates change constantly. Sometimes the changes can be dramatic, while other times, the week-to-week developments might only lead to a minor. Rate, Points, Change, Prior Year, YOY Change. MND's 30 Year Fixed (daily survey). Sep 05 9/5/24, %, --, %, %, %. Sep 04 9/4/ Mortgage rates may change throughout the day, however they only change on days when the Bond markets are trading securities since mortgage rates are based on. As we can see from looking at interest rate fluctuations, major economic events can significantly impact mortgage rates both in the short and long term. As. How often do interest rates change? Mortgage rates can change daily, sometimes multiple times a day. They're difficult to predict, though they're often. Thus, to counter this impact, lenders may inflate the interest rates, directly impacting the mortgage rates. Moving on from economic indicators, fiscal policies.